Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Costs can be described in different ways depending on how they relate to laboratory operations (direct/indirect), change with test volume (variable/fixed), pertain to staffing (salary/nonsalary), or are associated with the useful life of supplies or equipment (operating/capital). Cost per reportable result is a key indicator.

Reimbursement for laboratory services comes mostly from third-party payers, such as Medicare (government) and insurance companies (nongovernment/private insurance), and payments are almost always less than charges.

Inpatient laboratory testing charges are usually not reimbursed directly; they are considered part of a per diem rate (i.e., general hospital daily room reimbursement rate) or a case rate, such as diagnosis-related group rate (i.e., set rate for the entire hospital stay, regardless of actual length of stay). Thus inpatient laboratory testing is usually considered a “cost center.” In contrast, outpatient laboratory charges are reimbursed directly; therefore, outpatient testing is usually considered a “revenue center.”

For reimbursement purposes, Current Procedural Terminology codes describe tests, and International Classification of Diseases, Tenth Revision ( ICD-10 ) codes describe the diagnosis. Medical necessity requirements may limit reimbursement to those tests associated with specific predefined diagnoses.

Budgeting is the process of planning, forecasting, controlling, and monitoring the financial resources of an organization.

A variety of financial tools are used to evaluate a capital project, such as purchasing a chemistry analyzer. These measure how long it takes to recoup an investment (payback) and how much it generates in today’s dollars (net present value) and its rate of return (internal rate of return).

Laboratory equipment can be acquired in different ways, including purchase, lease, and per-test payment. Each has pros and cons.

Every organization, no matter the products or services it provides, must be concerned with the management, oversight, and accounting of its monetary resources. To sustain a viable, competitive entity, an organization not only must recoup the cost of operations but must have a positive net income to reinvest in itself. The laboratory is no exception. To be successful in the financial management of the laboratory, the director/manager must be able to identify and categorize costs, understand the relationships between revenue and reimbursement, become familiar with the budget process, and use financial ratios and information to make sound decisions. Credibility with administrators and colleagues demands that the director/manager be comfortable and confident when explaining financial issues and when justifying the need for additional resources.

Most industries in the United States are subject to traditional free-market competition. However, this principle does not fully apply to health care because relatively few people who use health care pay directly for it. Most people are beneficiaries of some form of health insurance. This, in combination with the number of uninsured and underinsured, has led to a system that provides services even when no one pays adequately for them. Most medical claims are paid by a third party, such as the government (Medicare, Medicaid) or a private insurance company. Thus someone other than the patient usually pays the provider of health care.

The health care industry is one of the largest industries in the United States and continues to be a growing sector of the gross domestic product, having increased from 5.1% ($27 billion) in 1960 to 17.9% ($3.5 trillion or $10,739 per person) in 2017 (Centers for Medicare & Medicaid Services [ ). Hospitals continue to be a driving force behind escalating health care costs. Most U.S. hospitals are tax exempt, not-for-profit entities. Though “not-for-profit” suggests that no profit is made, it actually means that profits are not distributed to owners or shareholders; instead, profits are reinvested in the organization. Historically, not-for-profit status led hospital administrators to be less profit conscious than counterparts in other businesses. However, today’s hospitals are having a difficult time just covering operating costs given dwindling reimbursement and increasing supply and labor costs. With scarce money left for capital reinvestment in equipment, buildings, facilities, and technology, hospitals are aggressively seeking new ways to produce a profit to invest for the future.

A cost (expense) is the supply, labor, and overhead money spent on a product or service ( ). It is important to understand costs to accurately price tests and other services, to determine when and how to offer new tests, and to determine whether to acquire new outreach client business or a managed care contract. Costs can be classified in different ways ( Table 13.1 ).

|

Direct costs are expenses that can easily be traced directly to an end product. In the laboratory setting, the end product is a billable test. Examples are reagents, consumables, and hands-on technologist time. In contrast, indirect costs are not directly related to a billable test but are necessary for its production. Indirect costs are often referred to as overhead. Examples are proficiency testing and utility expenses.

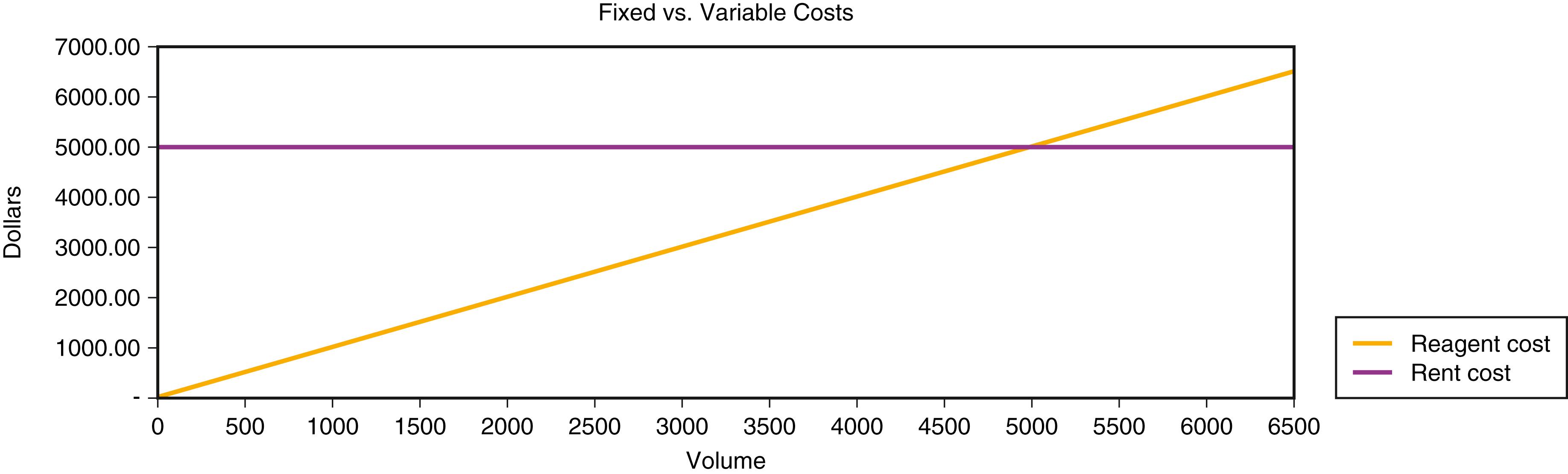

Variable costs change proportionately with the volume of tests. As test volume grows, so do reagent costs. If the reagent cost per test is $1.00, when 1000 tests are performed, the reagent cost is $1000; when 20,000 tests are performed, the reagent cost is $20,000. Fixed costs do not change with the volume of tests performed. If a laboratory pays $5000 per month to rent its space, this expense remains the same if the laboratory produces 1000 or 20,000 tests per month ( Fig. 13.1 ).

Because fixed costs do not vary with activity, the goal is to produce as much as possible from fixed costs to achieve economies of scale. The more that is produced, the lower the fixed cost per activity . In the preceding scenario, if the laboratory produced 1000 tests, the fixed cost per test is $5.00; with 20,000 tests, the fixed cost per test falls to $0.25. Note that even some fixed costs have a variable component. For example, if an instrument’s capacity is 20,000 tests per month and the volume increases beyond that, another instrument will have to be purchased, increasing the fixed costs per test. Fixed costs that change with increments of volume are called step costs .

Salary costs need to be looked at differently from nonsalary costs because salary costs have fringe benefits associated with them. Salary expenses account for approximately 50% to 70% of the laboratory budget. Because salary expenses are generally fixed, it is important to strive for economies of scale. The hourly pay or salaried wage of an employee is not the entire cost of employment. Fringe benefits such as Social Security, health insurance, tuition reimbursement, pension plans, and life insurance can represent an additional 16% to 28% expense above the base salary. Costs are also associated with the recruitment, interview, and selection process. Once an employee is hired, orientation, training, and ongoing growth and development costs are incurred.

Operating costs are the expenses incurred to produce a product or service. Many items have only a one-time use and, once used, the item has no further value. Examples of one-time operating costs include reagents, electricity, disposable pipettes, and the salary expense in the production of a test. Other items, such as analytic equipment, computers, and the physical plant, have a useful life greater than one production cycle. These items are capital items. To qualify as a capital item, it must meet three criteria: time, price, and purpose. To meet the time criterion, the item must have a useful life of longer than 1 year. The institution must designate a minimum dollar amount, usually $1000 to $5000, that qualifies an item as capital. The purpose of acquiring capital items is usually to replace older equipment with safer and more efficient models or to add new equipment to support new products or services. With time, capital equipment loses its value. The annual loss of a capital item’s value is called depreciation and is an annual expense that is deducted from the revenue of a business. Depreciation is not a cash expense (i.e., you do not “pay it” each year), but it is a real expense in that it recognizes the “wearing out” of an asset that was acquired with cash and eventually will have to be replaced. If an analyzer has not yet been fully depreciated, it still has “book value.” Note that operating and capital costs are budgeted separately (see later discussion).

The cost of producing a test can be derived in different ways. Microcosting determines the total direct labor and supply costs of producing a test, and it is the starting point for determining the fully loaded cost and ultimately the price for a test. Most testing in the clinical laboratory is performed in batches or continuous “runs” of many samples during one or more shifts. A run can be a group of tests that are performed once or many times during a shift or an entire 24-hour period. A run includes all quality control and calibration costs needed to produce patient results. When microcosting a test, it is important to consider how a test is performed because labor and supply costs vary according to workflow and laboratory policy for quality control and repeats. The cost per reportable result (CPRR) distributes the total direct costs of a run over the patient “reportable” results for that run. Testing efficiency is defined as the total reportable patient results/total test results. Thus the more repeats and controls performed, the lower the efficiency and the higher the CPRR. As testing efficiency increases, the CPRR decreases. The incremental cost is the cost of producing one additional test that, typically, does not require additional salary or capital. For example, the incremental cost of running a chemistry test is usually the cost of dispensing reagent for one additional test assuming that there are no sample collection costs. Other associated costs, such as technologist time, equipment, or quality control, are fixed costs that are incurred irrespective of the additional test. The incremental cost is usually the lowest possible cost incurred to produce a result. It is best used to assess how much it costs to produce small increments in test volume. As volume grows, a laboratory may need additional staff and equipment; these costs would have to be included in the incremental costing analysis. Incremental costing is especially useful when one is trying to determine whether additional outreach work is profitable or not. The fully loaded cost for a test is the sum of direct and indirect costs. The allocation of indirect costs is usually done using a formula. The goal of allocating indirect costs is to apply the costs based on the strongest correlation between the indirect cost and to what it is being applied. For example, utilities could be based on departmental square footage, while human resources costs could be based on the number of employees in the department. Make-versus-buy decisions should be based on the fully loaded cost to produce the test compared with the price offered by a commercial or reference laboratory. If it costs more to produce a test than to buy it from another supplier, the test should be considered for outsourcing. However, when make-versus-buy decisions are made, cost is only one factor to consider. Medically necessary turnaround time, methods, and reliability of the potential alternative supplier should also be considered. The price charged for a test needs to be marked up (increased) from the fully loaded cost to realize a profit. However, a profit may also be realized on additional business priced lower than the fully loaded cost, as long as the incremental revenue from the work exceeds the incremental cost of doing the work. One must also take into consideration the expected collection rate, relative to charge. The contribution margin is the balance remaining after the fully loaded costs are deducted from the price charged for a test. Table 13.2 demonstrates various ways to determine the cost of a test and how to establish its charge.

| Test: Prostate-Specific Antigen | |||

| A.Microcosting: Instrument Run of One Reportable Test | |||

| Direct Labor | |||

| Determine the total “hands-on” time in minutes required to perform an instrument “run” of one patient test. Assume labor cost is $20 per hour. | |||

| Minutes | Expense | ||

| Prepare specimen | 5 | ||

| Prepare reagents | 10 | ||

| Prepare instrument | 10 | ||

| Computer and/or worksheet setup | 5 | ||

| Documentation of results/quality control/maintenance | 10 | ||

| Cleanup | 10 | ||

| Total direct labor | 50 | $16.67 | |

| Direct Supplies | |||

| List all consumables needed to perform the test. Note that four tests (one sample and three controls) are needed to produce one patient reportable result. Calibration costs should be added if they are required with each run. | |||

| Unit cost | Units | Expense | |

| Reagent ($700 kit/100 tests) | $7 | 4 | $28.00 |

| Disposable pipettes ($10/100 pipettes) | $0.10 | 4 | $0.40 |

| Disposable reagent cups ($10/200 cups) | $0.05 | 4 | $0.20 |

| Low-, medium-, and high-control material (0.05 mL/test @ $20/mL) | $1 | 3 | $3.00 |

| Total direct supplies | $31.60 | ||

| Total direct costs | $48.27 | ||

| Cost per reportable (total direct cost/reportable results) | $48.27/1 | $48.27 | |

| Testing efficiency (reportable patient results/tests) | 1 result/4 tests | 25% | |

| B.Microcosting: Instrument Run of 15 Reportable Tests | |||

| Direct Labor | |||

| For a group of tests run on automated analyzers, use direct labor expense from microcosting. For manual batch testing, direct labor costs may apply to each batch; additional labor time studies may be necessary to derive accurate data. | |||

| Minutes | Expense | ||

| Total direct labor per batch (same as microcosting in this example) | 50 | $16.67 | |

| Direct Supplies | |||

| Note: 18 tests (15 samples and 3 controls) are needed to produce 15 reportable results. Fixed costs (controls) are spread over more than 1 sample, in contrast to first example. | |||

| Unit cost | Units | Expense | |

| Reagent ($700 kit/100 tests) | $7 | 18 | $126.00 |

| Disposable pipettes ($10/100 pipettes) | $0.10 | 18 | $1.80 |

| Disposable reagent cups ($10/200 cups) | $0.05 | 18 | $0.90 |

| Low-, medium-, and high-control material (0.05 mL/test @ $20/mL) | $1 | 3 | $3.00 |

| Total direct supplies | $131.70 | ||

| Total direct costs | $148.37 | ||

| Cost per reportable (total direct cost/reportable results) | $148.37/15 | $9.89 | |

| Testing efficiency (reportable patient results/tests) | 15 results/18 tests | 83% | |

| C.Incremental Cost: Cost for One More Test | |||

| Units | Expense | ||

| Reagent ($700 kit/100 tests) | 1 | $7 | |

| Disposable pipettes ($10/100 pipettes) | 1 | $0.10 | |

| Disposable reagent cups ($10/200 cups) | 1 | $0.05 | |

| Total | $7.15 | ||

| Unit cost | Units | Expense | |

| D.Fully Loaded Cost | |||

| Direct cost (cost per reportable result for typical size run) from Example B | $9.89 | ||

| Indirect cost (estimated by typical hospital as 2.5 × direct costs) | $24.73 | ||

| Fully loaded cost | $34.62 | ||

| E.Contribution Margin | |||

| Example of Charging a 20% Markup for Laboratory Tests | |||

| Fully loaded cost plus 20% mark-up | $34.62 × 1.2 | $41.54 | |

| (test charge at list price) | |||

| Fully loaded cost from Example D | ($34.62) | ||

| Contribution margin | $6.92 | ||

∗ This analysis is for illustration purposes only; real-life costs may be different.

The total cost of ownership (TCO) for a laboratory is the life cycle cost of its capital assets. It focuses attention on the sum of all costs of owning and maintaining all assets for a specific service or product as opposed to the initial capital or operating costs. In the laboratory, TCO includes acquisition, setup (construction, training), support (ordering supplies, dealing with backorders), ongoing maintenance (scheduled and unscheduled downtime), service, and operating expenses (reagents, controls, repeat testing, inventory control, proficiency testing, testing personnel, supervisory personnel) of a specific workbench and its associated testing instrumentation. TCO is useful in considering make-versus-buy decisions, but determining an accurate TCO can be very difficult.

Revenue is the total price of services rendered or products sold ( ). It is the money a business is entitled to receive for the services and products it produces. In health care, revenue should not be confused with reimbursement or cash collected. Gross patient revenue consists of the total charges at a facility’s full-established rates (list price) for provision of inpatient and outpatient care before deductions from revenue are applied. Net patient revenue is the gross inpatient and outpatient revenue minus all related deductions. Deductions from revenue include contractual adjustments, provision for bad debts, charity care, and other adjustments and allowances that reduce gross patient revenue. Contractual adjustments account for the difference between billings at full-established rates and amounts received or receivable from third-party payers under formal contract agreements. For example, if the list price of a test is $10 but the contracted payment from the insurance company is $6, the adjustment is $4. If all deductions and contractual allowances are correct, net patient revenue should equal cash collected, or $6 in this example.

In health care, it is important to distinguish between inpatient and outpatient care because they are reimbursed differently. Inpatient laboratory testing charges usually are not reimbursed separately; they are considered to be part of a per diem rate (i.e., general hospital daily room reimbursement rate) or diagnosis-related group (DRG) rate (i.e., set rate for the entire hospital stay, regardless of actual length of stay). Thus inpatient laboratory testing is considered a “cost center.” The hospital is paid the same rate regardless of how many tests are provided. In contrast, outpatient laboratory testing has historically been a revenue center because each test is separately reimbursed, usually by a third party ( Table 13.3 ). Thus there has been a financial disincentive to perform inpatient tests and an incentive to perform outpatient tests. However, because new reimbursement models focus on accountable care, shared risk, and bundled payments, incentives to perform outpatient testing are likely to change.

| List Price | Reimbursement Terms | Amount Paid | Contractual Allowance | |

|---|---|---|---|---|

| Inpatient | ||||

| Managed care (HMO) | $41.54 | No separate reimbursement for laboratory tests because they are included in the contracted per diem rate | 0 | N/A |

| Medicare | $41.54 | No separate reimbursement for laboratory tests because they are included in the DRG rate | 0 | N/A |

| Outpatient | ||||

| Indemnity insurance | $41.54 | Usual and customary charge (UCC) is $38; insurance pays 80% of UCC. | $30.40 | $11.14 |

| Managed care (PPO) | $41.54 | Contract pays 110% of Medicare fee schedule ($25.70 for PSA). | $28.27 | $13.27 |

| Managed care (HMO) | $41.54 | No separate reimbursement for laboratory tests because of capitation arrangement: Laboratory receives per member per month payment irrespective of usage | N/A | N/A |

| Medicare | $41.54 | Medicare fee schedule | $25.09 | $16.45 |

∗ Reimbursement amounts are for illustrative purposes only and may not accurately reflect current Medicare reimbursement.

Hospitals in early America served a different purpose from those of today. A visiting physician usually provided health care in the patient’s home, and care was administered by family members, midwives, and servants. Early hospitals were founded to shelter older adults, the dying, orphans, those with mental illness, and vagrants, and to protect the citizens of a community from contagious diseases and the dangerously insane. Many of today’s county, municipal, or religious order hospitals were originally a combination of these almshouses and isolation hospitals ( ).

The transformation of hospitals from charitable institutions to complex technical organizations came about with the passage of the Hill-Burton Hospital Construction Act of 1946 and the growth of private hospital insurance. The Hill-Burton Act provided federal money to the states to plan and construct new facilities. The first private health insurance policy was formed by a group of teachers and Baylor Hospital in Dallas to provide coverage for certain hospital expenses. This arrangement created the model for the development of what was to become Blue Cross Insurance. The development of health insurance to provide reimbursement for routine medical care carried gigantic implications. The original concept of any insurance was to guard against the low risk of a rare occurrence such as premature death or accident. Today’s health insurance provides for coverage of routine, predictable services and unforeseen illnesses and injuries ( ).

Private health insurance falls into two main categories: indemnity and managed care. Indemnity plans, also known as fee-for-service, are traditional insurance plans that give patients absolute freedom to choose their physicians and medical facilities. Insurance companies usually require the beneficiaries to fulfill a yearly deductible, which can often exceed $1,000 per person per year. After the deductible is fulfilled, the insurance company pays a certain coinsurance rate of the usual and customary charge (UCC). The UCC (or fee schedule) is set by the payer and is usually less than the actual billed charge, in which case the patient may be responsible for the balance. Generally, the coinsurance is split 70%/30% or 80%/20%, where the insurance company pays the higher percentage and the insured the lower. Indemnity plans were the mainstay of the health insurance world before the 1980s. Today, managed care is the norm. Some employers still offer indemnity plans despite their high premium payments to allow their employees the freedom to choose medical services.

As an alternative to indemnity health insurance, managed care was introduced in 1973 with the passage of the Health Maintenance Organization Act. This act encouraged and funded the development of health maintenance organizations (HMOs) as a strategy to contain the rising cost of health care ( ). HMOs utilized managed care features that coupled health care reimbursement with delivery of service and allowed payers significant economic control over how, where, and what services were delivered. In managed care, specific physicians and hospitals are selected to care for members; referrals from a case manager are usually necessary for specialty or inpatient services; and providers share in the financial risk through capitation agreements and per diem rates.

Capitation agreements pay the service provider (e.g., physician) a fixed dollar amount per member per month (PMPM). From this amount, the provider agrees to cover all care for plan members. For example, if a laboratory signs a capitation agreement to accept $1.50 PMPM for the outpatient testing needs of 2000 HMO members, the laboratory receives $3000 per month and $36,000 per year. If it costs the laboratory more than $36,000/year to provide the services, it realizes a financial loss; if it costs less than $36,000, it realizes a profit. In a capitation testing agreement, a laboratory assumes the risk of spending more than it is paid. One key to managing this risk is gaining access to test utilization of plan members and accurately assessing laboratory costs.

Per diem rates are negotiated with hospitals to provide all necessary care and services for managed members requiring inpatient care. Reimbursement for any laboratory testing during the inpatient stay is included in the per diem amount. As with capitation, if it costs more to provide inpatient services than the per diem rate, the hospital is at financial risk.

Sometimes, a service is separately negotiated (i.e., it is not included as part of the capitation or per diem rate). This is called a “carve out.” Expensive esoteric tests (e.g., certain molecular and genetic tests) should be carved out of the outpatient laboratory capitation agreement. A negotiated fee-for-service price for these tests is appropriate. By excluding these tests from capitation, one can avoid huge financial losses due to unexpectedly high utilization of these costly services.

Medicare is federal health insurance for individuals age 65 and older, individuals who are permanently disabled, and those with end-stage renal disease who have met the specified waiting period. Medicare was established in 1965 by Title XVIII of the Social Security Act. It is administered by the Centers for Medicare and Medicaid Services (CMS), a division of the U.S. Department of Health and Human Services (HHS). Coverage is provided under Parts A, B, C, and D. Claims are processed by CMS-approved contractors. These contractors are usually private companies that serve as fiscal intermediaries (generally processing Part A claims) and carriers (generally processing Part B claims). However, CMS is moving to a new model, whereby the Medicare Administrative Contractor (MAC) will administer both Part A and Part B claims via 12 MAC jurisdictions (as of 2018). For a clinical laboratory to qualify for Medicare/Medicaid reimbursement, the laboratory must maintain Clinical Laboratory Improvement Act of 1988 certification (CMS, 2017e).

Medicare Part A covers inpatient hospitalization, hospice care, skilled nursing care, and home health care. Coverage is automatic for those who are eligible. Before the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA), inpatient hospitalization was reimbursed on a retrospective cost-based system. This system paid hospitals for all costs incurred during an inpatient stay. After TEFRA, the system switched to a prospective payment system (PPS), which reimbursed hospitals on the basis of preset payments for services provided to patients with similar diagnoses. With this DRG payment system, hospitals are reimbursed the same amount for a specific DRG no matter how many discrete units of services are provided. Thus hospitals can earn a profit or realize a loss on each inpatient stay, depending on whether their costs are lower or higher than the DRG payment. The aim of the PPS, with its fixed DRG reimbursements, was to force hospitals to contain costs by reducing the length of stay and eliminating unnecessary and/or overutilized services ( ).

Medicare Part B covers outpatient laboratory tests, physician professional services, and other medical services and devices. Coverage is not automatic. Eligible beneficiaries must enroll for Part B coverage and pay premiums. Beneficiaries must pay an annual deductible and a 20% copayment for all Part B services, except for clinical laboratory testing, which is covered in full, provided certain conditions are met (see later discussion).

The Part B fee schedule plays an important role in reimbursement because it is a baseline that nongovernment payers use to establish their own rates. For example, a private insurance company may set its fee schedule at 110% of the Part B fee schedule.

Medicare Part C (also known as Medicare Advantage) is an alternative to the traditional Part B fee-for-service program. It is designed to reduce patient “out-of-pocket” costs by providing services through health maintenance organizations and other managed care service models. Medicare Part D provides prescription drug coverage.

Medicaid is a federal program that offers health care coverage for select low-income families. It was authorized in 1965 as a federal/state-sponsored program designed to pay medical costs for certain families with low income or inadequate resources. Eligibility extends to people who are aged, blind, or disabled, and those in families with dependent children. Although Medicaid is a federal program, it is under the jurisdiction of each individual state. This means that each state determines who is eligible, the range of health services offered, and how they are reimbursed. It is a common misconception that Medicaid covers health care costs for all low-income persons. Medicaid does not provide paid medical assistance to every single poor person. To receive medical assistance, a person must meet eligibility requirements.

To be paid, a medical claim must document the patient’s medical condition (or diagnosis) and must list the services (or tests) provided. This information is conveyed via a standardized coding system, recognized by all government and private payers: Healthcare Common Procedure Coding System (HCPCS) codes describe the test or service ( ), and International Classification of Diseases, Tenth Revision, Clinical Modification ( ICD-10-CM ) codes describe the patient’s condition or diagnosis ( ). These coding standards allow data to be accurately communicated among physicians, patients, and third-party payers.

The HCPCS was developed in 1983 and consists of two levels of codes. Level I is the Current Procedural Terminology (CPT) coding system, used to identify nearly all clinical laboratory tests and most medical services ( ). CPT codes are assigned by the American Medical Association (AMA) and are reviewed and updated annually to keep current with changes in technology and medical practice. Each CPT code consists of five digits and a description of the test or service. For example, the CPT code for a total prostate-specific antigen (PSA) test is 84153.

Level II HCPCS codes are assigned by the CMS. CPT does not contain all the codes needed to report services or to describe special circumstances that may apply to Medicare. The CMS developed this second level of codes to fill the gap. HCPCS Level II codes begin with a single letter (A through V), followed by four digits. These codes are updated annually by the CMS. An example of Level II coding is PSA for cancer screening, G0103. Note that the CMS treats this test differently than the PSA CPT code described earlier, even though the tests are identical to those of the laboratory. This allows the CMS to assign different criteria for reimbursement based on why a test is ordered.

The ICD was originally developed by the World Health Organization (WHO) as a classification system for reporting of mortality and morbidity statistics by physicians throughout the world. The ICD-10-CM is a U.S. clinically modified revision of the WHO ICD-10 . This modification is maintained and updated by the National Center for Health Statistics. These modifications assist health care providers to index patient records, retrieve case data for clinical studies, and submit claims for health care services. In contrast to ICD-9 , ICD-10 (implemented in 2015) provides much greater detail, precisely defines location (including laterality), and provides changes in terminology and expanded concepts for injuries and other related factors. As a result, ICD-10 is composed of about 68,000 codes (three to seven characters long), in contrast to ICD-9 ’s approximately 13,000 codes (three to five characters long) ( ).

Become a Clinical Tree membership for Full access and enjoy Unlimited articles

If you are a member. Log in here